Frequently Asked Questions

-

Why is the district asking voters for a millage?

Thousands of students in Hillsborough County are being impacted by a nationwide shortage of teachers and support staff.

- 10,000 students started the school year without a permanent full-time teacher.

- 8,000 students arrive late to school each day due to the bus driver shortage.

- Neighboring school districts and businesses in the community offer much higher pay.

Voters in school districts surrounding Hillsborough have approved a millage, allowing them to attract top employees.

- This gives Hillsborough’s neighbors $310 million in extra money to spend on competitive pay.

- A millage would cost a typical Hillsborough homeowner $281 a year, or about 75 cents a day.

- All of the funding from a millage would stay here in Hillsborough County to benefit our students.

A millage in Hillsborough would allow us to compete on behalf of our students.

- Teachers would receive a salary supplement of $6,000 more a year, with $3,000 more for support staff such as bus drivers and student nutrition workers, and $6,000 more for administrators such as principals and assistant principals.

- Those salary supplements would result in an 11% increase in pay for the average teacher or support staff member.

- Proposed expansions to academic programs include extended learning and the arts, college and career readiness, and athletics and P.E.

-

Why should I support this tax, especially if I don’t have children or grandchildren attending public schools?

Education has a direct impact on everyone, regardless of their level of involvement in schools. It results in higher incomes, better jobs, rising property values and a healthy economy. The children who sit in our classrooms today are the people who will soon handle your medications and repair your car. Our parents, grandparents, and neighbors paid for education for each of us—we have a lifetime obligation to invest in the next generation.

The impact of education reaches far beyond our schools:

- Quality schools preserve and improve property values.

- Strong schools attract companies with high paying jobs.

- Investing in our county’s largest employer supports our county’s economy.

-

How do voters know funds from the millage will be spent as promised?

Transparency and oversight are included in the referendum to make sure the money is spent exactly as promised.

- An independent oversight committee will review every dollar spent, similar to the successful Half-Penny Sales Tax Citizen Oversight Committee.

- Public reporting is required for all spending.

-

Between the Community Investment Tax (CIT), Half-Penny Sales Tax, and this millage referendum, why is it necessary to tax residents to support students?

With a nationwide shortage of teachers, the average campus in Hillsborough being more than 50 years old, and a massive increase in population, the need for funding for employee pay, maintenance and air conditioning, and new school construction is magnified in Hillsborough County.

The existing local and state taxes dedicated to schools put Florida at 50th out of the 50 states for spending on teacher pay and benefits according to the U.S. Census Bureau, and do not generate the income needed to maintain facilities and construct new classrooms.

This is why 45 of Florida’s 67 counties—covering 96% of Florida’s population—have voted for an additional local property tax, sales tax, or both to support students with additional local funding dedicated to schools.

By law, property taxes and sales taxes fund different parts of a school’s budget.

- A property tax (or millage) can be used for employee pay and academic programs.

- A sales tax, such as Hillsborough’s Half-Penny Sales Tax, can only be spent on buildings and maintenance.

- So, a school district like Hillsborough, with substantial needs in both the employee pay category and the building and maintenance category, would need both types of local investment—a property tax and a sales tax—to address both categories.

-

Why should teachers and school employees vote to increase their own taxes, essentially paying for their own raises?

The cost to a typical homeowner would be $281 a year, and it would lead to a proposed salary supplement of $6,000 more a year for all teachers; with $3,000 more for all support staff, such as bus drivers and student nutrition workers; and $6,000 more for administrators such as principals and assistant principals.

Combining the salary supplements with existing salaries would place the total pay for first-year teachers above most neighbors, and the pay for an experienced ten-year teacher above all neighboring counties. These projected estimated supplements are separate and in addition to any annually negotiated salary increases.

-

Why can’t the school district find the needed funding in its existing budget?

Our district has explored many alternative solutions. A millage referendum is a last resort. From eliminating positions, to reforming our finances, adjusting attendance boundaries, and repurposing schools, which have saved millions of taxpayer dollars.

But belt-tightening and fat-trimming can’t compete when our neighbors have a millage, giving them access to hundreds of millions of dollars of extra cash each year to spend on out-competing us for top talent.

Our district has already taken drastic steps to reduce spending.

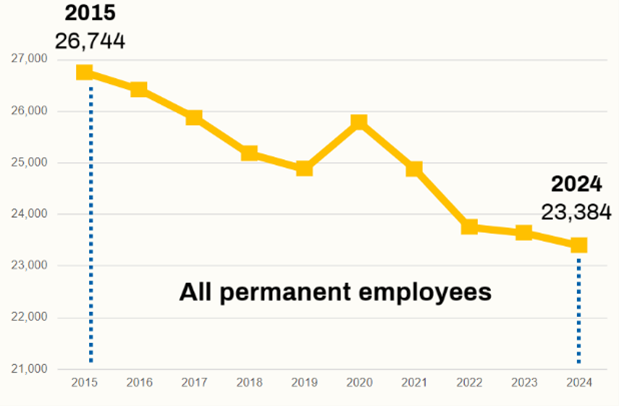

- We have eliminated more than 3,000 positions in the past decade based on our student enrollment numbers.

- We have repurposed schools and adjusted school boundaries in a process to decrease underutilized schools.

Our district has reformed how it:

- Approves or denies new hires and expenses.

- Projects student enrollment and assigns teachers to classrooms.

- Authorizes capital expense transfers.

- Right-sizes its workforce.

The financial overhaul has resulted in:

- Operating with a balanced budget.

- Our fund balance is healthy and stable.

- Receiving clean independent audits.

- Our bond rating—a grade from outside agencies on the district’s financial health—has been upgraded from an A- to an A.

To compete on behalf of our students with neighboring counties that already have a millage, our district would need more than $150 million in revenue each year.

-

Last time, voters said they didn’t trust that the district was financially responsible. What has changed?

As the Tampa Bay Times wrote in March 2024: “Once teetering on insolvency, the district has reduced its staff in recent years by more than 3,000 positions. It is enjoying larger reserves and higher ratings from the investment community.”

Fiscal Responsibility

- Our district has reformed how it:

- Approves or denies new hires and expenses.

- Projects student enrollment and assigns teachers to classrooms.

- Authorizes capital expense transfers.

- Right-sizes its workforce.

- The financial overhaul has resulted in:

- Operating within a balanced budget.

- Our fund balance being healthy and stable.

- Receiving clean independent audits.

- Our bond rating—a grade from outside agencies on the district’s financial health—has been upgraded from an A- to an A.

Half-Penny Sales Tax Success

- In 2018, voters approved a Half-Penny Sales Tax for 10 years, which can only be spent on buildings and maintenance, not on competitive pay for teachers or other academic programs.

- Our district has used these taxpayer funds responsibly to create a substantial impact on students—investing $662 million to date, with 120 air conditioners overhauled or replaced and more than 3 million square feet of aging roofs replaced, in addition to other significant projects at schools.

- A Citizen Oversight Committee reviews every dollar spent. The independent committee is made up of respected community leaders who meet every three months and issue public reports on the results.

Right-Sizing Our Workforce

- To use taxpayer dollars as efficiently as possible, our district has eliminated 3,360 positions over the past decade.

- This totals 1 out of every 8 positions in our district.

- When a position opens after an employee’s departure, that position may be reviewed and eliminated if appropriate.

- Our district has reformed how it:

-

What would this millage referendum do to help the highest needs students in the district?

High-needs schools are the ones most impacted by teacher shortages.

- Our district’s Transformation Network highest-needs schools have nearly double the number of unfilled teaching positions compared to other schools (86% more).

- The millage’s $6,000 supplement for teachers would be on top of $5,000 in current Spark bonus pay for teachers in high-needs schools.

- High-quality teachers and administrators are two of the five key levers that drive student achievement. (The American Institute for Research (AIR) and The Nine Characteristics of High-Performing Schools, 2016)

-

Will the increased millage make our taxes the highest they’ve ever been?

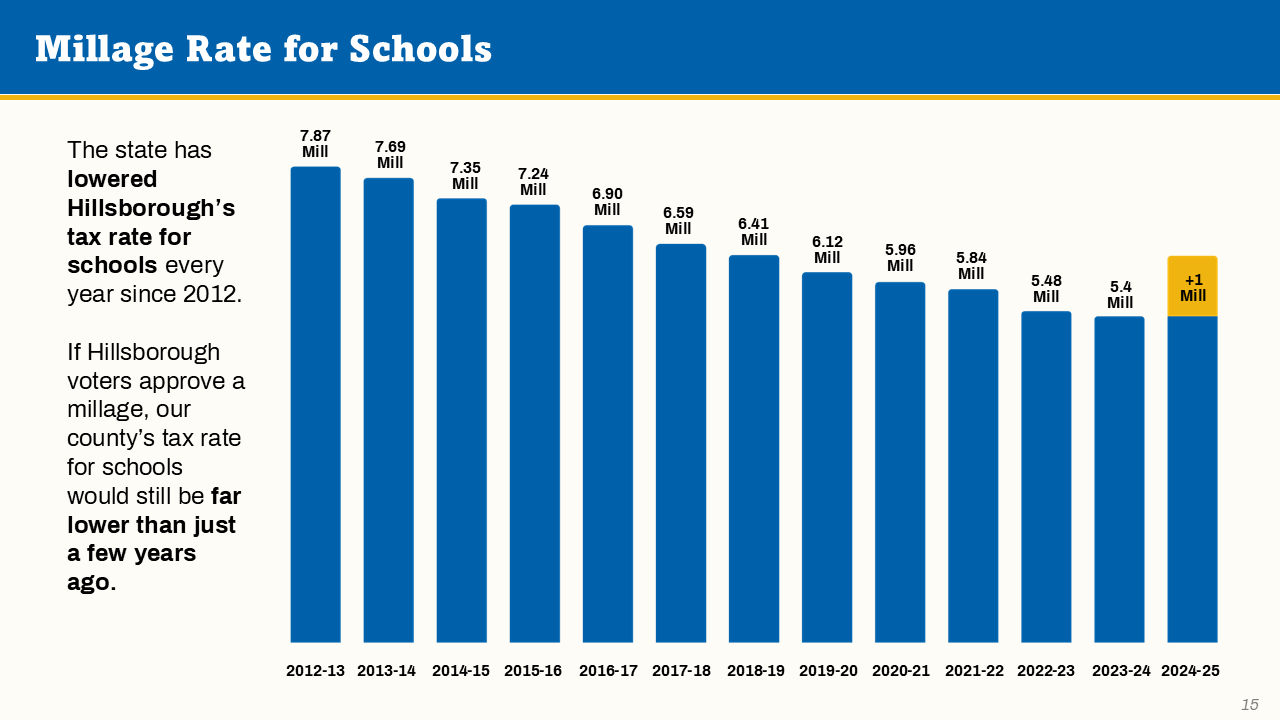

No. The state has lowered Hillsborough’s tax rate for schools every year since 2012.

- Hillsborough’s tax rate for schools has gone down from 7.9 mills to 5.4 mills in that time.

- So even if Hillsborough voters approve a millage referendum for 1 mill, our county’s tax rate for schools would still be far lower than just a few years ago.

-

Why ask the public for this money now?

This is incredibly urgent for our students.

- The same increases you may be seeing in cost of living—are impacting the educators, counselors, bus drivers, nurses, security officers, and student nutrition workers who our students are counting on.

- Our students deserve high quality teachers in every classroom. So, our district needs to have competitive pay, right now, to compete with our neighbors and the other career options that are drawing great people away from our district.

-

Why can’t the district use its fund balance to pay teachers more?

Fund balances in the general fund are the district’s reserves against revenue shortfalls, emergencies, and other unplanned needs and required by state statute. Having a health reserve has also increased our bond ratings from an A- to an A.

-

What is the breakdown of what this millage will be used for?

By gathering these funds, a millage would raise an estimated $177 million to support our students each year.

- A projected $150.4 million would be invested at schools operated by Hillsborough County Public Schools

- A projected $26.6 million would be invested in charter schools, as required by state statute.

- Revenue amounts are projected estimates for fiscal year 2025-26, when the funds would first be available for use; the projected amount for charter schools is based on student enrollment, and is current as of 1/23/2024

Of the estimated $150.4M for district schools:

- Our recommendation is that 92% would be dedicated to competitive pay

- Working with our employee groups, our recommendation is for teachers to receive a salary supplement of $6,000 more a year, with $3,000 more for support staff such as bus drivers and student nutrition workers, and $6,000 more for administrators such as principals and assistant principals

- Working with our employee groups, our recommendation is for teachers to receive a salary supplement of $6,000 more a year, with $3,000 more for support staff such as bus drivers and student nutrition workers, and $6,000 more for administrators such as principals and assistant principals

- 8% is proposed for academic programs

-

- The millage will also help us to enrich our educational programs for our students.

- If approved, we will add a full day of VPK for Hillsborough County Public School students – providing early learning opportunities so students are better prepared when entering kindergarten.

- We will hire a College and Career Counselor at Every High School - With more than 60,000 high school students across our district, the need for this life-changing guidance is tremendous

- We will add new Sports Options and P.E. Equipment - Adding new sports options for students and replacing worn physical education and recess equipment

- And we will create Learning Field Trips for Every Grade - taking students beyond classroom walls at no cost to students, including transportation.

- Plus, a new Vision for Nature’s Classroom – with staffing to support new exhibits and experiences at the school district’s unique outdoor learning center along the Hillsborough River

- The millage will also help us to enrich our educational programs for our students.

-

How does your proposal compare to how other districts use their millage?

Voter approved in 2022 - Pasco has a 1.0 mill.(after approx. 10.5% to charter) - 100% non-administrative salary supplements.

Voter approved in 2004; renewed in 2008, 2012, 2016, 2020 - Pinellas has a 0.5 mill.(after approx.7% to charter) - 74% teacher salary supplements, 26% other topics like classroom libraries, technology, training, literacy and field trips.

Voter approved in 2018, renewed in 2018 - Manatee has a 1.0 mill.(after 18.2% to charter) - 62% teacher salary supplements, 18% support staff salary supplements, 7% administrator salary supplements, 13% STEAM, CTE

Voter approved in 2018, renewed in 2022 - Miami-Dade has a 1.0 mill.(after 25.1% to charter) - 88% teacher salary supplements, 12% safety and security positions.

Voter approved in 2018, renewed in 2022 - Broward has a 1.0 mill.(after 19.9% to charter) - 72% teacher and support staff salary supplements, 20% safety and security positions, 8% mental health and guidance positions.

Voter approved in 2010, renewed in 2014, 2018, 2022 - Orange has a 1.0 mill. (after 8.7% to charter) - 60% preserve academic programs & retain teachers, 33.7% protect arts, 4.7% protect athletics, 1.6% protect activities.

-

How did you calculate the average cost for the typical homeowner?

This information comes from the Hillsborough County Property Appraiser’s Office.

With a millage, property owners pay $1 for every $1,000 in taxable value.

As an example, the value of typical home in Hillsborough is $306,000.

Taking out the $25,000 homestead exemption would equal $281,000 in taxable value for schools.

Using the formula above ($1 for every $1,000 in taxable value), the cost to a typical homeowner would be $281 per year, which averages to about 75 cents a day.

Millage Referendum Calculator>>

-

Can the district educate voters on how the millage funding would be utilized and how it would positively impact student success?

The role of the school district is to educate, not advocate. Community members may choose to organize an advocacy campaign in the coming months—any advocacy campaign would be operated by community members and operated separately from the school district.

-

How will the millage impact class sizes?

Our district already follows Florida’s laws to ensure appropriate class sizes for core subjects like reading and math. A millage aims to make sure the students in those classrooms have high quality, full-time teachers every day.

-

How many teachers and administrators have left to go to another district?

Our district asks about this in exit surveys, but most respondents simply select “personal reasons,” regardless of their actual reason for leaving.

- Across the country, school districts are facing a nationwide teacher shortage.

-

- In 1990, 1 in 10 college students majored in Education to become teachers.

- By 2021, only 1 in 25 college students majored in Education. And it’s been that way for a decade.

- As of September 2024, we have 450 teacher vacancies.

- The results of a Hillsborough Classroom Teachers’ Association survey show:

-

- 2/3 of teachers have considered leaving our district in the past 24 months

- Nearly 9 out of 10 personally know a teacher, support staff member, or administrator who has left because of pay

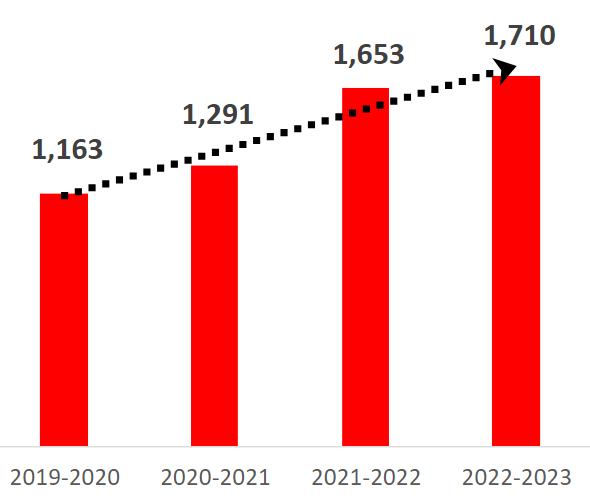

- The number of teachers leaving the district before retirement has seen a steady increase in the past five years. (See chart below)

-

What percentage of teachers and principals are new to schools this year?

- Teachers – Around 10% of our teachers just started with us this year.

- As of September of 2024, we have over 13,000 teachers in our district.

- Principals – More than 10% of our principals are brand new in the role this year.

- Since 7/1/2023, 24 principals have been appointed new to the role in our district, out of 234 current principals.

- Teachers – Around 10% of our teachers just started with us this year.

-

How would this supplement work when it comes to bargaining?

This is separate and in addition to any negotiated salary increase. Other neighboring districts make this clear in their negotiations and on their salary schedules. Our district will be able to add in the supplemental increase. Our district intends to make agreements in advance with union partners.

-

Does the school district receive funds from the Florida Lottery?

Most lottery money goes to college scholarships – known as Bright Futures. In fact, lottery money makes up less than ½ of 1% of our district’s budget.

-

What about impact fees? Can the district utilize those funds for teacher pay?

Impact fees are for capital expenditures only. For building new schools or maintenance on existing ones.

-

Supporters of Amendment 3 are claiming money will go to the schools. Can we use those funds for teacher pay?

If passed, amendment 3 could raise sales tax revenue for the state of Florida. The governor would have to include any additional funds for education from that revenue in his budget.

Charter Schools

-

How will charter schools benefit from a millage? Do charter schools have to follow the district’s proposal of 92% for competitive pay and 8% for academic programs?

Under Florida law, charter schools receive a share of the funds based on their enrollment. A charter school’s use of millage funds must be consistent with ballot language. Chapter 1011.71(9) states that: Funds levied under this subsection shall be shared with charter schools based on each charter school’s proportionate share of the district’s total unweighted full-time equivalent student enrollment and used in a manner consistent with the purposes of the levy.

-

This website is intended to educate the public on the millage referendum. In proposing a millage referendum to voters, our district has a responsibility to educate the public on the vital needs a millage would address, how millage revenue would be invested to positively impact students and our community, and the transparency and accountability measures in place to ensure that impact is delivered. Section 106.011, Florida Statutes, both precludes the school district from expending taxpayer funds for a political advertisement or other communications sent to electors concerning a referendum and specifically allows the following from the school district to inform the public: “reporting on official actions of the local government’s governing body in an accurate, fair, and impartial manner; posting factual information on a government website or in printed materials; hosting and providing information at a public forum; providing factual information in response to an inquiry; or providing information as otherwise authorized or required by law.”